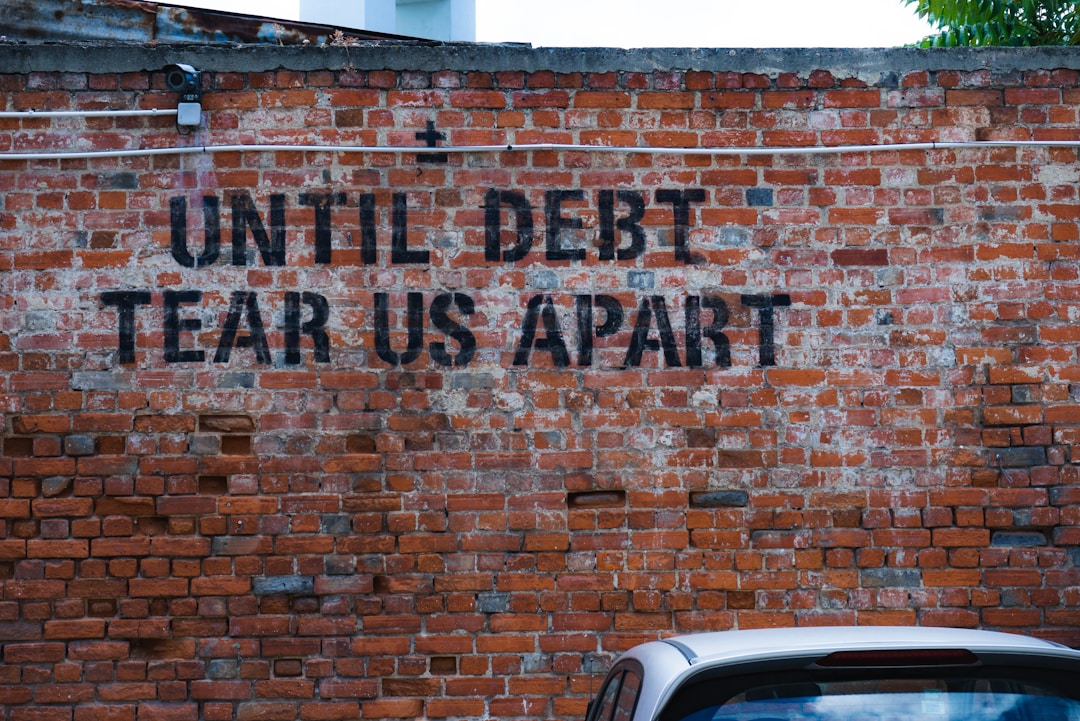

Debt is a commonality for most American adults. Married couples have a notorious amount of debt including home mortgages, car payments, and credit card debt. While you may have a team attitude towards paying off debt when you’re married, this isn’t true when you’re entering a divorce. What happens to your debt when you get divorced? And what about your property? Take a look at what happens to property and debts when going through a divorce.

Legal Liability For Debt

Determining who is liable for incurred debt depends on what type of property state you live in. A community property state will deem both of you equally liable for debts regardless of who incurred them. An equitable distribution state will deem the person who incurred the debt responsible for paying it. Regardless of how liability is determined for debt, financial institutions still expect you to pay anything that’s in your name. If you have an outstanding balance on a joint credit card, both your names are on the account and failure to pay the assigned debt can negatively affect the other’s credit score.

Some homeowners take advantage of the special credit card offers to finance home improvement projects. The bathroom is one of the most popular rooms to renovate because it increases the value of a property. You don’t have to spend a lot to update your bathroom. Builders Discount Warehouse stocks the largest range of bathroom supplies including bathroom vanities, tubs, toilet suites, shower screens, mirrors, faucets, sinks, bathroom fixtures, and accessories. You can find great prices on quality bathroom furniture and fittings made of vinyl, acrylic, stainless steel, stone, and porcelain. They also carry restroom supplies for commercial restrooms such as toilet seat covers, caddies, gel dispensers, and tapware.

Distribution of Community Property

Divorce assets are distributed depending on the type of property state you live in. A community property state will divide all assets and debt acquired throughout the marriage an even 50-50. Any assets and debts acquired before marriage or after separation or divorce are deemed separate property. An equitable distribution state will distribute all assets and debts equitably rather than equally. This means each spouse will be awarded a percentage of the total value of the personal property, assets, and debts.

A simpler way to approach the division of property, assets, and debts is to apply for consent orders. It’s a legally binding final order that details the financial arrangements you and your spouse agree to. These are upheld by enforcement actions to discourage non-compliance. The family law attorneys at PCL Lawyers have years of experience helping clients through the consent findings process and ensuring the orders are fair and equitable.

Division of Marital Assets

Divorce leaves both spouses with fewer assets than they had when married. The easiest way to divide assets is to do so amicably with the help of a mediator, otherwise, a judge will need to be involved. Before splitting assets, you’ll need to take a thorough inventory. Each spouse will need to honestly fill out an asset and debt sheet. Failure to disclose assets can easily result in 100 percent of the assets being awarded to the other spouse. It could also result in the order to pay the other spouse’s legal fees and penalties, or a dismissal of all claims.

Each spouse will decide which assets are marital and separate. Depending on the state, separate assets may be considered during equitable distribution. Property, savings and retirement accounts, stock and investment portfolios, country club memberships, life insurance, and business ownership are all considered marital assets.

Deciding together how your assets should be split is the best way to simplify the division process civilly. If you can’t agree, a judge will review the dispute and make a determination of the division of assets. The type of property state you live in will determine how property and debt are divided in divorce.

Debt is a commonality for most American adults. Married couples have a notorious amount of debt including home mortgages, car payments, and credit card debt. While you may have a team attitude towards paying off debt when you’re married, this isn’t true when you’re entering a divorce. What happens to your debt when you get divorced? And what about your property? Take a look at what happens to property and debts when going through a divorce.

An equitable distribution state will deem the person who incurred the debt responsible for paying it. Regardless of how liability is determined for debt, financial institutions still expect you to pay anything that’s in your name.

You can find great prices on quality bathroom furniture and fittings made of vinyl, acrylic, stainless steel, stone, and porcelain. They also carry restroom supplies for commercial restrooms such as toilet seat covers, caddies, gel dispensers, and tapware.

Before splitting assets, you’ll need to take a thorough inventory. Each spouse will need to honestly fill out an asset and debt sheet. Failure to disclose assets can easily result in 100 percent of the assets being awarded to the other spouse. It could also result in the order to pay the other spouse’s legal fees and penalties, or a dismissal of all claims.

Thanks For Reading

More Read On Businessmodulehub

![division-material-property-assets-1240x575[1]](https://backup.businessmodulehub.com/wp-content/uploads/2021/09/division-material-property-assets-1240x5751-1-696x323.png)