You love a little extra money, right? It always helps to have a little leftover, especially during the month end when you have to pay the laundry guy and the newspaper guy, and you barely have Rs 500 in your pocket. Or even if the end of the month greets you with an urgent, doctor’s appointment this extra cash can be a blessing!

Well, want to make sure you always have this “extra cash” handy? Then, you must have some liquid assets in hand. And if you’re wondering what in the world do we mean by this, then fret not. This article will resolve all your doubts and questions about liquidity in your investments and why is it important.

Liquidity simply means how simply and quickly you can convert your assets into cash. For instance, you cannot sell your house or your car at a moment’s notice in order to generate some immediate cash in hand, right? Even if by some miracle you do find a way to do this, it is a risky and foolish fallback option to generate liquid cash.

So what is the alternative? Carrying around a large pile of cash in your hand anticipating an emergency? That makes no sense. Firstly you don’t want to get robbed. Neither do you want to park all your money in a savings bank accounts which generates negligible returns?

So, how else can you ensure that you can get your hands on the money anytime you need? By ensuring you have a handy pool of liquid assets.

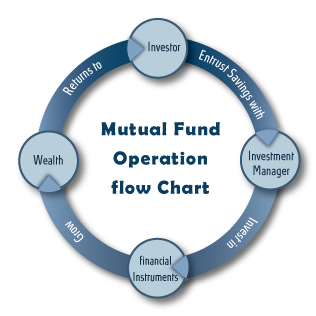

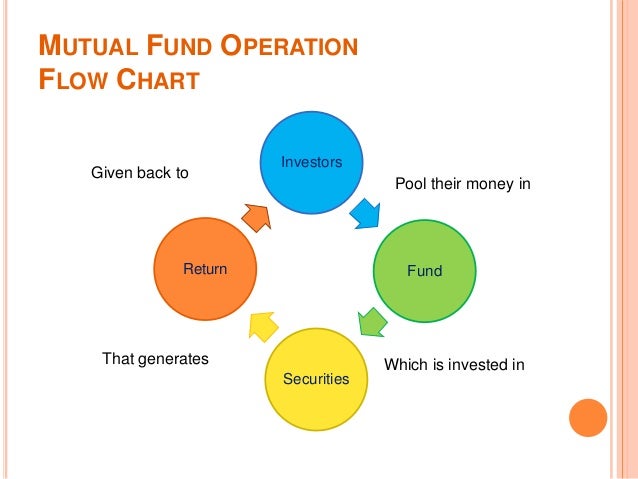

It would help to have certain types of mutual funds in your portfolio, which can be immediately redeemed for easy, quick cash.

Liquidity in assets like stocks and mutual funds can also help you escape market volatility and uncertainties and optimize your returns. You can move your money whenever and where ever you feel right, depending on the market situations.

If you’re under the illusion that mutual funds are solely for long term investments, think again. Liquid funds can help you invest and reap returns in the short run. They are ideal for you if you are looking to park your surplus for a short period of time and use the same when you have a cash crunch and in urgent need of money.

Liquid Funds are a type of debt mutual funds for you to invest in for a short period of time. These schemes mostly invest in money market instruments like treasury bills, commercial papers etc. for a period of 91 days. So, all your short-term savings can be invested here. Short and sweet, right?

Also, since they have a short term investment horizon, they are mostly open-ended schemes. This means you can enter and exit the scheme anytime you want.

There is no lock-in period, so you are not bound to stay for a specific period to withdraw your money. The basic idea of these funds is to preserve your money for a short period of time while giving you good returns. You can withdraw your money anytime you want, anytime you need.

Depending on your needs, you can invest for a few days or a few months. You can even redeem a part of your investments within 24 hours if you so desire!

The best part is, once you exit, you do not have to pay any exit load. Plus, since the fund returns are according to the market rates, you get a decent return over your savings.

An important aspect of liquidity is the fact that your asset should not reduce in its value, in your bid to convert it into cash. This is where assets like gold or real estate fall short.

Not to mention the hassles, countless taxes and upkeep charges that these incur. So, why bear the brunt? Simply invest in liquid funds and escape all these troubles, while enjoying good returns!

And if you belong to the old school of thought, preferring a savings accounts over investing money in mutual funds, it’s time to revisit your notions. While parking your money in a savings account seems like an easy way out, they do not give enough returns, as compared to mutual funds.

Savings accounts offer a meager return of around 4%, as compared to 7-9% generated by liquid mutual funds. Why opt for less when you can have more?

Considering the importance of liquidity and the many options you have for investment purposes, opt for liquid mutual funds and get the most out of your money, today. Use a fintech app like Sqrrl, to start investing in liquid funds today.